Content

However, this doesn’t necessarily mean they will be the best candidate to provide the help you need with your income tax preparation. The IRS explains that CPAs, attorneys and enrolled agents are all allowed to legally represent their clients before the IRS. They have a more thorough understanding of tax code than an individual operating solely with a PTIN or an Annual Filing Season Program participant who provides their services on a volunteer basis. Consider the complexity of your tax return and what level of expertise you’ll require.

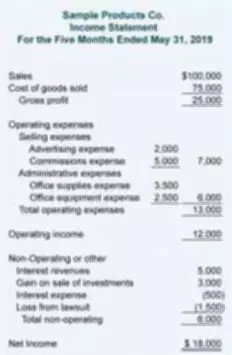

The bookkeeper’s job is to plan, direct, and control the financial aspects of a company or organization, following generally accepted accounting principles. Duties for a bookkeeper will vary based on the size of the organization and the type of business or industry. However, each aspect of the job should be performed according to Generally Accepted Accounting Principles (GAAP) to maintain reasonable consistency and integrity. For registration assistance and a list of partners and affiliate schools, see the Partners Page.

Accountant, Sr – Projects – Austin Bridge and Road

See the careers section for more information about the top related careers and the salaries in San Antonio, and visit the career pages for detail on skill requirements, day-to-day work, compensation, tips, and more. With Bookkeeping encompassing so many verticals and subtopics, it could be challenging to find what you’re looking for. We’ll help you break down the subcategories and related topics (see the Bookkeeping topics section) to focus directly on one of the subcategories. Due to changing schedules and uncertainty during COVID-19, we recommend that prospective students confirm course availability directly with the school. Note that beginner courses still typically assume basic proficiency with computers.

Accountants are financial professionals who have received an accounting degree from a four-year university or college. By trade, accountants prepare, maintain and examine the financial statements of an individual, business or institution. An accountant prepares reports for tax purposes and can also perform audits of public companies. https://www.bookstime.com/ Whether you’re a single, self-employed person or a company generating millions of dollars in revenue, we offer you the peace of mind you deserve when it comes to tax preparation and other money-related work. That’s why we’ve evolved our business to become a highly reputable solution to bookkeeping stress and anxiety.

OUR SERVICES

Guerrero CPA is headed by Ed Guerrero, who holds numerous certifications, including Great Plains Certified Accounting Applications Specialist and QuickBooks ProAdvisor. Accountants’ rates vary based on their education, licenses, experience, and the work for which they are being hired. An accountant may charge an hourly rate when a company or individual needs their services on a short-term basis, such as when performing an audit or requesting assistance setting up a financial database or process. Hourly rates can range as widely as $40 per hour to $300 or more per hour, depending on your geographic location and the accountant. On average, individual tax preparation services cost $242, and prices typically range from $137- $454.

Is bookkeeper outdated?

Accounting is progressively becoming more automated thanks to the cloud-based accounting software provided by Xero. Bookkeeping and data entry are becoming less necessary in today's world because offices are increasingly moving towards becoming paperless, mobile, and global.

Neither CNM nor Noble Desktop can assist with registration for non-partner schools. For those with some familiarity with Bookkeeping looking to advance or add to their skills, these courses provide those with experience the perfect opportunity to skill-up. All these courses require prerequisite knowledge, and we’ve included a brief note for many of them, but you should check with the school for more details on the entry requirements.

Educational Background for Bookkeepers in San Antonio, TX

Trust our bookkeeping company to improve your financial situation and develop a personalized plan for your future. Additionally, according to survey results, 35% more practitioners will charge the same hourly rate for all services in 2021. To know more about San Antonio’s tax preparation services, contact eBetterBooks. For small and medium-sized firms, the typical cost of outsourced accounting services ranges from $500 to $2,500 per month, depending on the required hours. At eBetterBooks, we creatively enhance our customers’ management and accounting workflows.

Passing journal entries and maintaining accurate records in books of accounts are all included in bookkeeping. One must remember that bookkeeping is crucial for businesses if they want to succeed in the long term, aside from the advantages it offers for taxation and other external factors. To comprehend your company and make more informed selections, you require bookkeeping bookkeeping services san antonio services in San Antonio. Once you have the best bookkeeping services in San Antonio, you will have adequate time to focus on other core areas of your business. We pride ourselves on providing a personalized accounting service that will adapt to meet your needs as you change and grow. Our bookkeeping services provide an easy and effective process, saving you time and money.

Service Area

As the best accounting and tax services in San Antonio, we’ll let you work on running your business. For group classes, in-person training in San Antonio ranges from $53/hour to $61/hour, and live online training ranges from $0/hour to $217/hr. We’re a ‘by the numbers’ yet creative team of experienced professional bookkeepers led by Kassie Soldano, founder and CEO. But, navigating the numbers and building a thriving, healthy business isn’t easy – especially if bookkeeping isn’t your expertise. Our comprehensive bookkeeping services ensure your finger remains on the pulse of your finances while you spend your time focusing on other aspects of life or business. We keep you informed about all transactions with complete statements and keep companies in compliance with any required government reporting.